In this document you will find:

- Capital Allowances

- Capital Taxes

- Corporation Tax

- Income Tax Rates and Bands

- Individuals

- Inheritance Tax

- Investments

- ISAs

- Land Tax Duties

- National Insurance

- Private Residences

- Tax Free Mileage Allowances

- VAT Rates

Capital Allowances

| 2022/2023 | 2023/2024 | 2024/2025 | |

| Main rate pool: writing down allowance | 18% | 18% | 18% |

| Main rate pool: Full expensing | N/A | N/A | N/A |

| Main rate pool: Super deductions | 130% | 130% | N/A |

| Single asset pools: Super deductions | N/A | N/A | 6% or 18% |

| Special rate pool (long life assets, integral features): writing down allowance | 6% | 6% | 6% |

| Special rate pool: Full expensing | N/A | 50% | 50% |

| Special rate pool: Super deductions | 50% | 50% | N/A |

| Annual Investment Allowance (AIA) cap: | £1,000,000 | £1,000,000 | £1,000,000 |

| Structures and Buildings Allowance | 3% | 3% | 3% |

The AIA allows businesses to invest in equipment and fixtures (cars and buildings don't qualify), with 100% tax relief in the year of purchase.

The AIA cap has been permanently set at £1,000,000. If the accounting period is shorter or longer than 12-months the AIA cap is apportioned based on the length of the period.

Super deductions and full expensing can only be claimed by companies subject to corporation tax. Where either of these reliefs are claimed the items must not be pooled. When an items for which the super deduction or full expensing has been claimed is sold, it can result in a balancing charge.

Super deductions cannot be claimed for plant and machinery which is bought to be leased to another party unless it is back ground plant and machinery in leased buildings.

Capital Taxes

Enveloped Dwellings

Annual tax on Enveloped Dwellings (ATED)

The annual charges per property in each of the valuation bands are:

| Property value £ | Annual charge 2020/21 £ | 2021/22 £ | 2022/23 £ | 2023/24 £ | 2024/25 £ | 2025/26 £ |

| Up to 500,000 | Nil | Nil | Nil | Nil | Nil | Nil |

| 500,001 to 1,000,000 | 3,700 | 3,700 | 3,800 | 4,150 | 4,400 | 4,450 |

| 1,000,001 - 2,000,000 | 7,500 | 7,500 | 7,700 | 8,450 | 9,000 | 9,150 |

| 2,000,001 - 5,000,000 | 25,200 | 25,300 | 26,050 | 28,650 | 30,550 | 31,050 |

| 5,000,001 - 10,000,000 | 58,850 | 59,100 | 60,900 | 67,050 | 71,500 | 72,700 |

| 10,000,001 - 20,000,000 | 118,050 | 118,600 | 122,250 | 134,550 | 143,550 | 145,950 |

| Over £20,000,000 | 236,250 | 237,400 | 244,750 | 269,450 | 287,500 | 292,350 |

ATED applies where a residential property located in the UK is owned by a non-natural person such as; a company, partnership with a corporate member or a collective investment scheme.

For the years 2023/24 to 2027/28 the property valuation is its market value on 1 April 2022, or when acquired, if later. For the previous five years the property valuation point was 1 April 2017, or the date of acquisition if later.

There are a large number of reliefs and exemptions from the charge, and where such a relief applies an ATED relief declaration must be submitted. In other cases where an ATED charge is due the ATED return must be delivered to HMRC and the charge paid by 30 April within the chargeable year that runs from 1 April to 31 March.

Capital Gains Tax

The rates and annual exemption for capital gains tax are as follows:

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | 2024/25 | 2025/26 | |

| Annual exemption | £12,300 | £12,300 | £12,300 | £6,000 | £3,000 | £3,000 |

| Annual exemption for most trustees and personal representatives | £6,150 | £6,150 | £6,150 | £3,000 | £1,500 | £1,500 |

| Rate for gains within the basic rate band | 10% | 10% | 10% | 10% | 10/18%* | 18%* |

| Rate for gains above the basic rate band | 20% | 20% | 20% | 20% | 20/24%* | 24%* |

| Gains on residential property and carried interest within the basic rate band | 18% | 18% | 18% | 18% | 18% | - |

| Gains on carried interest within the basic rate band | - | - | - | - | - | 32% |

| Gains on residential property above the basic rate band | 28% | 28% | 28% | 28% | 24% | 24% |

| Gains on carried interest above the basic rate bandband | 28% | 28% | 28% | 28% | 28% | 32% |

| Rate for gains subject to Business Asset Disposal Relief | 10% | 10% | 10% | 10% | 10% | 14% |

| Rate for gains subject to Investors’ Relief | 10% | 10% | 10% | 10% | 10% | 14% |

| Lifetime limit for gains subject to Business Asset Disposal Relief | £1m | £1m | £1m | £1m | £1m | £1m |

| Lifetime limit for gains subject to Investors’ Relief | £10m | £10m | £10m | £10m | £10m/£1m* | £1m |

Corporation Tax

Rates

The rates for the three financial years from 1 April 2021 are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 | 2024 | 2025 |

| Corporate Tax main rate | 19% | 19% | 25% | 25% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% | 19% | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 | £50,000 | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 | £250,000 | £250,000 |

| Standard fraction | N/A | N/A | 3/200 | 3/200 | 3/200 |

| Main rate (all profits except ring fence profits) | 19% | 19% | N/A | N/A | N/A |

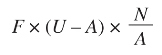

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400, for all financial years from 2008.

Research and Development (R&D)

R&D merged scheme and enhanced intensive support (periods starting on or after 1 April 2024)

The merged scheme R&D expenditure credit (RDEC) and enhanced R&D intensive support (ERIS) replace the old RDEC and small and medium-sized enterprise (SME) schemes for accounting periods beginning on or after 1 April 2024. The expenditure rules for both are the same, but the calculation is different.

You can choose to claim under the merged scheme even if you are eligible for ERIS, but you cannot claim under both schemes for the same expenditure.

The merged scheme is a taxable expenditure credit and can be claimed by trading companies that are chargeable to Corporation Tax and have a project that meets the definition of R&D.

For expenditure under the merged scheme, the rate of R&D expenditure credit is 20%.

Enhanced intensive support (ERIS) allows loss-making R&D intensive SMEs to deduct an extra 86% of their qualifying costs in calculating their adjusted trading loss, as well as the 100% deduction which already appears in the accounts (or in the computations) to make a total of 186% deduction as well as claim a payable tax credit, which is not liable to tax and is worth up to 14.5% of the surrenderable loss.

SME scheme (periods starting before 1 April 2024)

Small and medium (SME) companies can claim enhanced deductions for expenditure on R&D projects at 186% (230% before April 2023) of qualifying expenditure. Where the deduction is claimed and the company makes a loss, it can claim a cash credit from HMRC of 10% of that loss from 1 April 2023, previously 14.5%. Where the SME spends at least 40% of their total expenditure on qualifying R&D from 1 April 2023, it can claim the higher payable tax credit of 14.5%.

Each R&D project must be carried on in a field of science or technology and be undertaken with an aim of extending knowledge in a field of science or technology.

Research and Development Expenditure Credit (RDEC) scheme (periods starting before 1 April 2024)

Large companies can claim an extra 20% deduction from 1 April 2023 on the following qualifying expenditure:

- Staffing costs

- Expenditure on externally provided workers

- Software and materials consumed or transformed

- Utilities but not rent

- Payments to clinical volunteers

- Subcontractors of qualifying bodies and individuals/partnerships

For staff working directly on the R&D project, you can claim for the following costs, as long as they relate to R&D:

- Bonuses

- Salaries

- Wages

- Pension fund contributions

- Secondary Class 1 National Insurance contributions paid by the company

RDEC differs from the previous R&D scheme for large companies as it is an 'above the line' tax credit and can be accounted for in the profit/loss statement.

Income Tax Rates and Bands

Recent income tax rates and bands are as follows:

| 2021/22 | 2022/23 | 2023/24 | 2024/25 | 2025/26 | |

| Savings rate: 0% | Up to £5,000 | Up to £5,000 | Up to £5,000 | Up to £5,000 | Up to £5,000 |

| Dividend Allowance: 0% | Up to £2,000 | Up to £2,000 | Up to £1,000 | Up to £500 | Up to £500 |

| Basic rate: 20% | Up to £37,700 | Up to £37,700 | Up to £37,700 | Up to £37,700 | Up to £37,700 |

| Higher rate: 40% | £37,501 - £150,000 | £37,701 - £150,000 | £37,701 - £125,140 | £37,701 - £125,140 | £37,701 - £125,140 |

| Additional rate: 45% | Over £150,000 | Over £150,000 | Over £125,140 | Over £125,140 | Over £125,140 |

When the personal allowance (£12,570) is taken into account an individual will start to pay tax at 40% when their total income exceeds £50,270. This threshold (and the 45% threshold) can be increased if the taxpayer pays personal pension contributions or makes gift aid donations.

Scottish Income Tax Rates and Bands

Scottish income tax applies to non-savings and non-dividend income. Reforms to the Scottish tax system led to a new Advanced band of income tax coming into force from 6 April 2024, meaning the country moves further away from the set up in the rest of the UK.

The new rates and thresholds from April 2025 look like this.

| Tax rate | Income thresholds | |

| Personal allowance | 0% | Up to £12,570 |

| Starter Rate | 19% | £12,571 to £15,397 |

| Basic Rate | 20% | £15,398 to £27,491 |

| Intermediate Rate | 21% | £27,492 to £43,662 |

| Higher Rate | 42% | £43,663 to £75,000 |

| Advanced Rate | 45% | £75,001 to £125,140 |

| Top Rate | 48% | Over £125,140 |

This is how the rates and thresholds looked prior to the changes:

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | 2024/25 | |

| Starter rate: 19% | Up to £2,085 | Up to £2,097 | Up to £2,162 | Up to £2,162 | Up to £2,306 |

| Basic rate: 20% | £2,086 to £12,658 | £2,098 to £12,726 | £2,163 to £13,118 | £2,163 to £13,118 | £2,307 to £13,991 |

| Intermediate rate: 21% | £12,659 to £30,930 | £12,727 to £31,092 | £13,119 to £31,092 | £13,119 to £31,092 | £13,992 to £31,092 |

| Higher rate: 42% | £30,931 to £150,000 | £31,093 to £150,000 | £31,093 to £150,000 | £31,093 to £125,140 | £31,093 to £75,000 |

| Advanced rate: 45% | £75,001 to £125,140 | ||||

| Additional rate: 46% (47% from April 2023 & 48% from April 2024) | Over £150,000 | Over £150,000 | Over £150,000 | Over £125,140 | Over £125,140 |

Individuals

Personal Allowances

The standard personal allowance has been frozen at £12,570 for all years from 2021/22 to 2027/28.

The transferrable marriage allowance applies from 6 April 2015 to couples (married or civil partners) where neither person pays tax at the 40% or 45% rates. The spouse who cannot use all their personal allowance against their own income may opt to transfer 10% of their personal allowance to their spouse or civil partner.

The personal allowance is tapered away for individuals who have income over £100,000, at the rate of £1 for every £2 of income above that threshold.

The allowances for recent years are as follows:

| 2020/21 (£) | 2021/22 (£)* | 2022/23 (£) | 2023/24 (£) | 2024/25 (£) | 2025/26 (£) | |

| Personal Allowances | £12,500 | £12,500 | £12,570 | £12,570 | £12,570 | £12,570 |

| Minimum married couples allowance | £3,450 | £3,510 | £3,640 | £4,010 | £4,280 | £4,360 |

| Maximum married couples allowance | £8,915 | £9,075 | £9,415 | £10,375 | £11,080 | £11,270 |

| Marriage allowance | £1,250 | £1,250 | £1,260 | £1,260 | £1,260 | £1,260 |

| Blind person's allowance | £2,450 | £2,500 | £2,600 | £2,870 | £3,070 | £3,130 |

| Income limit for allowances for Married couple’s allowance | £29,600 | £30,200 | £30,400 | £30,400 | £37,000 | £37,700 |

| Income limit for standard allowances | £100,000 | £100,000 | £100,000 | £100,000 | £100,000 | £100,000 |

| Personal allowance removed completely at: | £125,000 | £125,000 | £125,140 | £125,140 | £125,140 | £125,140 |

Inheritance Tax

The inheritance tax (IHT) nil rate band (NRB) is set at £325,000 until April 2028. The rates of IHT payable on death are at 40% or 36% where at least 10% of the net estate is left to charity. An additional nil-rate band (the ‘residence nil rate band’ (RNRB)) applies where an individual dies after 5 April 2017 and their estate is above the NRB. The RNRB applies when the whole or part share in the deceased’s home is passed on death to direct descendants. The maximum value of the RNRB is the lower of: the value of the home passed on, and the amount in the table below

| Year of death | Value of RNRB |

| 2017/18 | £100,000 |

| 2018/19 | £125,000 |

| 2019/20 | £150,000 |

| 2020/21 | £175,000 |

| 2021/22 | £175,000 |

| 2022/23 | £175,000 |

| 2023/24 | £175,000 |

| 2024/25 | £175,000 |

The value of RNRB is tapered away at £1 for every £2 by which the value of the total estate exceeds £2 million. This threshold is frozen until 2027/28.

Investments

Seed Enterprise Investment Scheme (SEIS)

SEIS was introduced to encourage people to invest in companies that have just started trading by offering tax reliefs to investors that buy shares in the company.

The table below shows the income and capital gains tax reliefs that apply:

| Tax Year | 2013/14 to 2022/23 | 2023/24 | 2024/25 | 2025/26 |

| Rate of income tax relief | 50% | 50% | 50% | 50% |

| Maximum investment qualifying for income tax relief | £100,000 | £200,000 | £100,000 | £100,000 |

| Gains exempt from CGT relief on reinvestment in SEIS shares: | 50% | 50% | 50% | 50% |

Enterprise Investment Scheme (EIS)

EIS is available to companies that are looking to grow by offering tax reliefs to investors that buy new shares in the company.

The table below shows the income tax reliefs that apply:

| EIS | 2012/13 to 2017 | From 2018/19 |

| Rate of income tax relief | 30% | 30% |

| Maximum investment qualifying for income tax relief | £1,000,000 | £2,000,000 |

To qualify for the maximum of £2m, at least £1 million of that is invested in knowledge-intensive companies.

A gain made on the disposal of EIS shares after holding them for at least three years is exempt from CGT to the extent that full income tax relief has been claimed, and not withdrawn, on the investment.

A gain made on the disposal of EIS shares after holding them for at least three years is exempt from CGT to the extent that full income tax relief has been claimed, and not withdrawn, on the investment.

Where the disposal proceeds from any capital gain are reinvested in a subscription for EIS shares in the four-year period that starts one year before the date of the gain, all or part of the original gain can be deferred. The deferred gain is brought back into charge on the disposal of the EIS shares or on a breach of the investment conditions

Social Investment Tax Relief (SITR)

This relief was withdrawn on 5 April 2023.

The table below shows the income and capital gains tax reliefs that apply:

| SITR | 2014/15 to 2022/23 |

| Rate of income tax relief | 30% |

| Maximum investment qualifying for income tax relief | £1,000,000 |

Venture Capital Trusts (VCTs)

VCTs were introduced to encourage people to invest in companies that have just started trading by offering tax reliefs to investors that buy shares in the company.

The figures below shows the income and capital gains tax reliefs that apply:

| VCT | ||

| Rate of income tax relief | 30% | |

| VCT | ||

| Maximum investment qualifying for income tax relief | £200,000 | Individual shareholders must be aged 18 or over. The relief applies if their shares are held for at least five years. |

ISAs

The ISA investment limits are as follows:

| 2019/2020 | 2020/2021 | 2021/2022 | 2022/2023 | 2023/2024 | 2024/2025 | 2025/2026 | |

|---|---|---|---|---|---|---|---|

| ISA for shares and/or cash | £20,000 | £20,000 | £20,000 | £20,000 | £20,000 | £20,000 | £20,000 |

| Junior ISA and Child Trust Fund | £4,368 | £9,000 | £9,000 | £9,000 | £9,000 | £9,000 | £9,000 |

From 1 December 2015 to 30 November 2019 first time buyers could open a Help to buy ISA to help save for their first home. The Government contributed a 25% bonus, up to £3,000 per ISA payable when the funds are used to buy the home. Though phased out in November 2019 the Help to buy ISA is still operating for existing account holders.

From 6 April 2017 UK resident individuals aged between 18 and 40 may open a Lifetime ISA to save up to £4,000 per year. The first payment is made before you reach 40. The Government will contribute a 25% bonus up to £1,000 per year. Savers can invest up to £4,000 each year, until the age of 50. The funds can be withdrawn from age 60 onwards or when the saver is terminally ill. The savings may also be used to help purchase the saver’s first home worth up to £450,000, after the account has been open for at least 12 months. The Government bonus will be lost if the funds are accessed for other purposes.

Premium Bonds

Individuals may invest up to £50,000 in premium bonds. Any winnings are tax free.

The odds of winning a prize for each £1 bond number are currently 22,000 to 1. There are two £1m prizes per month. The balance of the prize fund is allocated into three value bands: 10% in the higher band ( £5000 to £100,000) , 10% in the medium band (£500 and £1000) and 80% in the lower band ( £100, £50 and £25).

Land Tax Duties

Stamp Duty Land Tax

Residential Land or property

Stamp Duty Land Tax (SDLT) is charged on transactions of land or buildings located in England or Northern Ireland. The amount due is calculated at each rate on the portion of the purchase price which falls within each rate band. The tax is payable within 14 days on the completion date of the deal.

As of April 2025, the bands and rates were:

| Rate | Property value band |

| 0% | Up to £125,000 |

| 2% | £125,001 - £250,000 |

| 5% | £250,001 - £925,000 |

| 10% | £925,001 - £1,500,000 |

| 12% | Over £1,500,000 |

A supplement of 5% applies where purchaser owns an interest in two or more homes at the end of the day of the transaction, and the property is not a replacement for their main home, or the purchaser is a corporate body.

First Time buyers' relief

This can apply where all the purchasers of the property have never owned an interest in a residential property. The buyers must intend to live in the home as their main residence and the purchase price must not exceed £500,000.

As of April 2025, first time buyers' relief applies so means eligible buyers will pay 0% on the first £300,000 and then 5% on the remainder up to the maximum £500,000 price.

Non-Residential or mixed property

| Rate from 17 March 2016 | Purchase price/lease premium or transfer value |

| 0% | Up to £150,000 |

| 2% | £150,001 - £250,000 |

| 5% | Over £250,000 |

Lease rentals

| Effective date | Residential property | Non-residential or mixed property | Rate |

| NPV of rents | NPV of rents | % | |

| From 23 September 2022 to 31 March 2026 | Up to £250,000 | Up to £150,000 | 0 |

| Over £250,000 | £150,001 to £5m | 1 | |

| N/A | Over £5m | 2 | |

| From 1 October 2021 to 22 September 2022 | Up to £125,000 | Up to £150,000 | 0 |

| Over £125,000 | £150,001 to £5m | 1 | |

| N/A | Over £5m | 2 | |

| From 1 July 2021 to 30 September 2021 | Up to £250,000 | Up to £150,000 | 0 |

| Over £250,000 | £150,001 to £5m | 1 | |

| N/A | Over £5m | 2 |

Where the chargeable consideration includes rent, SDLT is payable on the lease premium and on the 'net present value' (NPV) of the rent payable.

Where the annual rent for the lease of non-residential property amounts to £1,000 or more, the 0% SDLT band is unavailable in respect of any lease premium.

Land and buildings transaction tax

Residential Land or property

Land and buildings transaction tax (LBTT) is charged on transactions concerning property located in Scotland from 1 April 2015.

As of April 2025, the bands and rates were as follows:

| Band | Rate |

| £0-145,000* | 0% |

| £145,0001 - £250,000 | 2% |

| £250,001 - £325,000 | 5% |

| £325,001 - £750,000 | 10% |

| £750,000 and above | 12% |

* For first-time buyers the nil rate band ceiling is £175,000 due to a tax relief

The Additional Dwelling Supplement (ADS) may also apply at a flat 8% rate for some transactions for contracts entered into on or after 5 December 2024 (6% for contracts entered into on or before 4 December 2024).

Non-Residential or mixed property

Lease rentals

| Rate from 7 February 2020 | NPV of rents |

| 0% | Up to £150,000 |

| 1% | £150,001 to £2 million |

| 2% | Over £2 million |

Land Transaction Tax

Land transaction tax (LTT) applies to transactions of land and property located in Wales from 1 April 2018. The higher rates, shown below, may apply for those buyers who already own one or more residential properties.

Residential property

Rates as of April 2025:

| Wholly residential property value: | Main rate % | Wholly residential property value: | Higher rates % |

| Up to £225,000 | 0 | Up to £180,000 | 4.0/5.0* |

| £225,001 - £400,000 | 6.0 | £180,001 - £250,000 | 7.5/8.5* |

| £400,001 - £750,000 | 7.5 | £250,001 - £400,000 | 9.0/10.0* |

| £750,001 - £1,500,000 | 10.0 | £400,001 - £750,000 | 11.5/12.5* |

| Over £1,500,000 | 12.0 | £750,001 - £1,500,000 | 14.0/15.0* |

| Over £1,500,000 | 16.0/17.0* |

*Higher rates before and after 11 December 2024

Non-residential and mixed use.

Shops, offices and agricultural land are examples of where this might apply.

Rates as of April 2025:

| Purchase price | Rate for freehold purchase or lease premium |

| Up to £225,000 | 0% |

| £225,000 to £250,000 | 1% |

| £250,000 to £1 million | 5% |

| Over £1 million | 6% |

Lease rentals

| NPV of rents threshold | Rate |

| Up to £225,000 | 0% |

| £225,000 to £2 million | 1% |

| Over £2 million | 2% |

National Insurance

The rates and thresholds for National Insurance Contributions for 2024/25 are:

| Class: | Monthly earnings | Rate |

| Employer Class 1 above Secondary threshold | Over £758 | 13.8% |

| Employee's class 1 | £1048 to £4189 | 10% |

| Employee's additional class 1 | Over £4189 | 2% |

| Self-employed class 2 (per week) | N/A | £3.70 |

| Share fishermen class 2 (per week) | N/A | £4.10 |

| Volunteer development workers class 2 | N/A | £6.15 |

| Class 3 (per week) | N/A | £17.45 |

| Annual profit thresholds | ||

| Self-employed class 2 | Over £12,570 credit available if profits between £6725 and £12,570 |

|

| Self-employed class 4 | £12,570 to £50,270 | 8% |

| Self-employed class 4 additional rate | Over £50,270 | 2% |

Private Residences

Main residence relief (also known as ‘principal private residence’ relief (PPR)) provides relief from capital gains tax on the disposal of (or of an interest in) a dwelling which has been the individual’s only or main residence, and on land enjoyed with that residence as its garden or grounds up to half a hectare, or more if the additional land is required for the reasonable enjoyment of the property.

The relief is time apportioned for periods of occupation, and for certain periods of deemed occupation. In particular, relief for the final 9 month period of ownership is given, if the property was at some time the individual’s only or main residence.

Where two or more properties are owned, the taxpayer may elect, within certain time limits, which property is to be treated as his main residence.

Married couples and civil partners may have only one main residence at any time between them which qualifies for the relief.

Tax Free Mileage Allowances

| First 10,000 business miles in the tax year | Each mile over 10,000 miles in the tax year | Extra passenger making same trip | |

| Cars and vans | 45p | 25p | 5p |

| Motorcycles | 24p | 24p | N/A |

| Bicycles | 20p | 20p | N/A |

These rates represent the maximum tax-free mileage allowances for employees using their own vehicles for business. Any excess is taxable. If the employee receives less than the statutory rate, tax relief can be claimed on the difference.

VAT Rates

The VAT rates and thresholds are as follows:

| From | 1 April 2019 | 1 April 2020 | 1 April 2021 | 1 April 2022 | 1 April 2023 | 1 April 2024 |

| Lower rate | 0% | 0% | 0% | 0% | 0% | 0% |

| Reduced rate | 5% | 5% | 5% | 5% | 5% | 5% |

| Standard rate | 20% | 20% | 20% | 20% | 20% | 20% |

| Registration turnover | £85,000 | £85,000 | £85,000 | £85,000 | £85,000 | £90,500 |

| Deregistration turnover | £83,000 | £83,000 | £83,000 | £83,000 | £83,000 | £88,000 |

| Acquisitions from EU member states, registration and deregistration threshold | £85,000 | £85,000 | £85,000* | £85,000* | £85,000* | £90,500* |

* From 1 January 2021 this is only relevant for supplies of goods into Northern Ireland.

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.